Introduction

The Paystand X API is a RESTful interface that enables synchronization of your ERP data with Paystand X. Use the API to sync customer and receivable records from your ERP, including creating and updating records as needed. You can also programmatically attach files to receivables.

Paystand emits webhook events to reflect key accounts receivable actions in our platform, such as applying payments to invoices and reconciling deposits when cleared funds transfer to your bank account. Use these events to automatically update your ERP and maintain alignment with your AR activity in Paystand.

Integrate this API with any middleware or iPaaS solution (such as Zapier, SmartConnect, or Merge.dev) to manage communication between your ERP and Paystand X.

Getting Started

API Capabilities

The Paystand X API provides comprehensive functionality for managing your accounts receivable operations:

Customer Management

- Create, retrieve, update, and delete customer records

Receivable Management

- Create, retrieve, update, and delete receivable (invoice) records

- Track payment status and amounts applied to receivables

File Attachments

- Upload, update, and delete PDF attachments to receivables

- Support for multiple PDF files per receivable

Transaction Tracking

- View detailed transaction history for each receivable

- Access payment, refund, and dispute information

- Monitor payment application and clearing status

Transfer Management

- Retrieve transfer records generated by Paystand to merchant bank accounts

- Track payout status, amounts, and settlement information

- Monitor bank account transfers and clearing status

Real-time Webhook Events

- Payment Events: Complete payment lifecycle notifications

- Receivable Transaction Events: Payment application to invoices

- Refund Events: Refund processing and status updates

- Dispute Events: Chargeback and dispute resolution notifications

- Transfer Events: Payout and settlement confirmations

- Fee Events: Merchant fee and charge confirmations

Prerequisites

- Paystand X Dashboard with API capability enabled

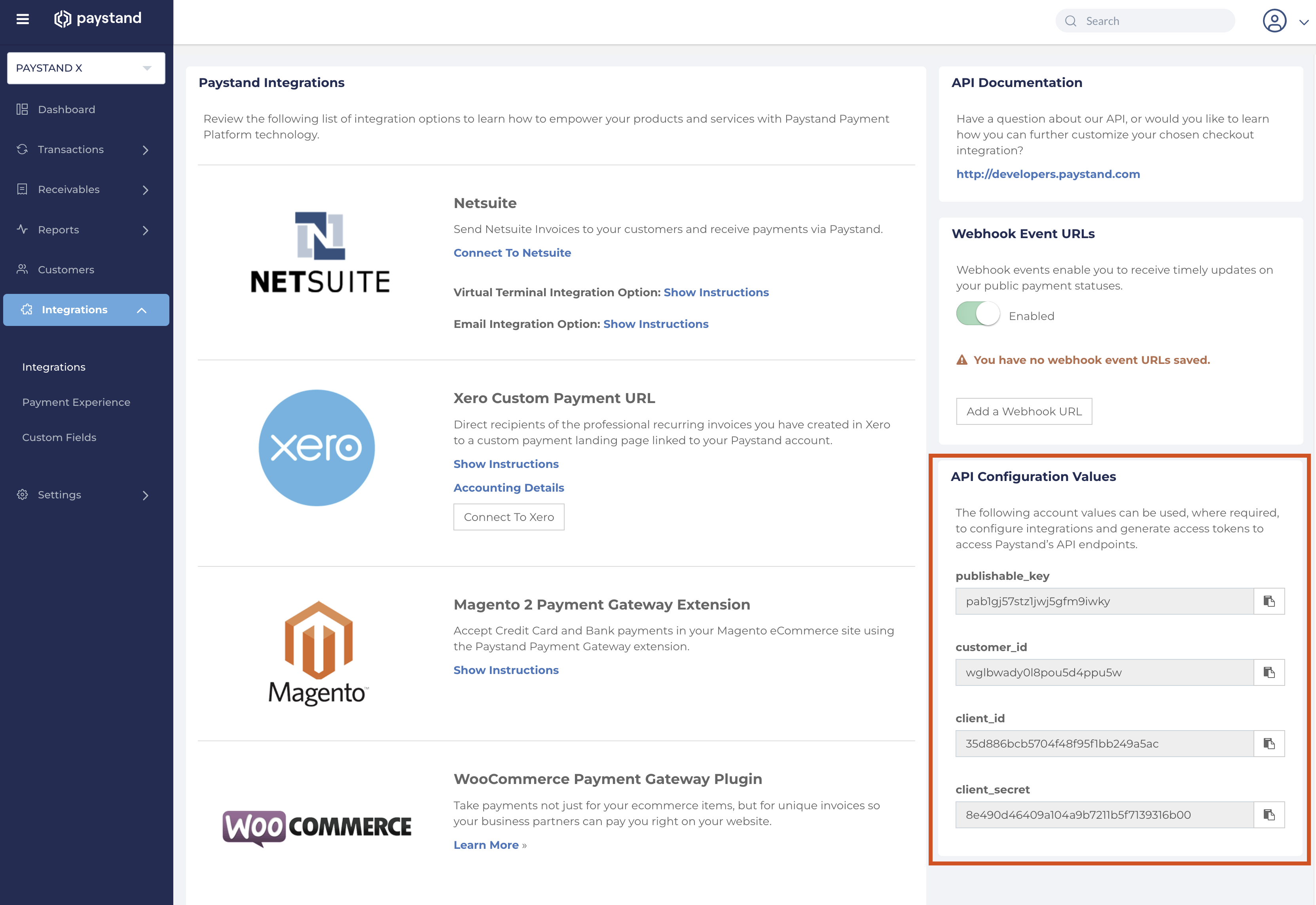

- API credentials (

client_id,client_secret, andcustomer_id) to generate the access token - Basic understanding of REST APIs and Bearer token authentication

Quick Start

- Obtain API credentials from Paystand Dashboard > Integrations Section (

client_id,client_secret, andcustomer_id)

- Generate an access token using the Access Token endpoint

- Test your connection with a simple API call such as List Customers

- Set up webhook events to receive real-time updates (learn more)

Environments

- Production:

https://api.paystand.com/v3 - Sandbox:

https://api.paystand.co/v3

Each environment requires separate API credentials and access tokens. Make sure to use the appropriate base URL and credentials for your target environment.

Testing the API

Use your sandbox credentials and environment to test your integration. You can test all API endpoints (such as creating records) using the sandbox environment. To simulate test payments specifically, you can find testing credentials for different payment methods in our testing documentation.

Authentication

The Paystand X API uses Bearer Token Authentication and JSON for all requests and responses. Each request must include an Authorization header containing a valid access token, an X-CUSTOMER-ID header with your customer ID, and an Accept header:

Authorization: Bearer your_access_token

X-CUSTOMER-ID: customer_id

Accept: application/json

The X-CUSTOMER-ID is obtained from Paystand Dashboard > Integrations Section as the customer_id value, while the access token is generated using the Access Token endpoint.

The API returns standard HTTP status codes with JSON error responses for proper error handling.

This token-based authentication method allows secure and stateless access to the API from your application or middleware.

⚠️ Token Validity: Access tokens are valid for 2 weeks. Refresh tokens before expiration to maintain persistent API access.

Rate Limiting

The API implements rate limiting to ensure fair usage:

- 3,000 requests per minute per API key

Rate limit headers are included in all responses to help you monitor usage and avoid hitting limits.

For Support

If you have questions or want more information about this document or Paystand products and services, please contact us by sending an email to support@paystand.com.

Authentication

- HTTP: Bearer Auth

Security Scheme Type: | http |

|---|---|

HTTP Authorization Scheme: | bearer |

Bearer format: | JWT |